Easy and Safe Lending App - Qcash

Category:Finance Update Time:Nov 3 2025

Version:9.22.5.3Size: 19.14 MB

Download

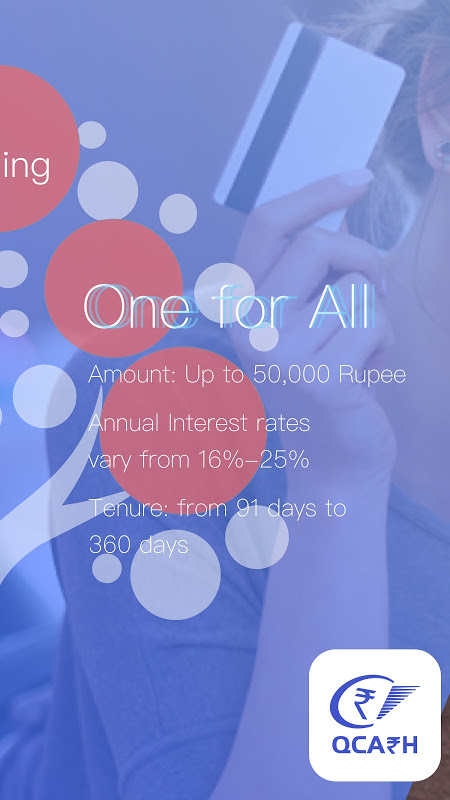

Easy and Safe Lending App - Qcash revolutionizes digital borrowing in India with its AI-driven platform. Tailored for users aged 18–51, it offers instant loans from ₹5,000 to ₹50,000, flexible repayment tenures (91–360 days), and competitive interest rates (16%–25% p.a.). Designed for financial inclusion, Qcash eliminates traditional bank queues with seamless in-app processing, transparent fee structures, and 24/7 customer support, making it a top choice for urgent needs like education, travel, or medical expenses.

Features of Easy and Safe Lending App - Qcash:

1. Flexible Loan Amounts: Borrow between ₹5,000–₹50,000 based on eligibility.

2. Customizable Tenure: Repay over 91–360 days to suit your financial capacity.

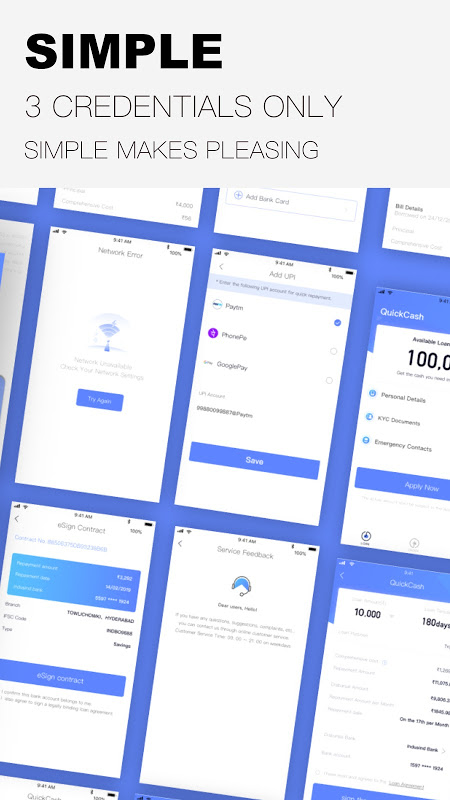

3. AI-Powered Approval: Quick credit assessment using big data for instant decisions.

4. Transparent Fees: Clear breakdown of processing fees (5%–15%) + GST, no hidden charges.

5. Multiple Repayment Channels: Repay via UPI, net banking, or debit/credit cards within Easy and Safe Lending App - Qcash.

6. 24/7 Support: Round-the-clock assistance for application or repayment queries.

Advantages of Easy and Safe Lending App - Qcash:

1. Inclusive Accessibility: Targets young Indians with limited credit history.

2. Quick Disbursement: Funds transferred directly to bank accounts upon approval.

3. User-Friendly Interface: Simple navigation for loan applications and tracking.

4. Low Interest Rates: Competitive rates compared to many fintech lenders.

5. Revolving Credit: Re-borrow once existing loans are repaid.

Disadvantages of Easy and Safe Lending App - Qcash Full Version

1. Geographic Restriction: Available only to Indian citizens.

2. Processing Fees: Up to 15% + GST may increase borrowing costs.

3. Credit Score Impact: Repeated applications might affect credit history.

4. No Physical Branches: Entirely app-based, limiting in-person assistance.

Development Team:

Developed by Gurgaon-based Microsloop, Qcash leverages a fintech-specialized team with expertise in AI, machine learning, and big data analytics. The company focuses on democratizing financial access through secure, scalable digital solutions aligned with India’s digital economy goals.

Competitive Products:

- MoneyTap: Offers credit lines but charges higher interest rates (up to 30% p.a.).

- EarlySalary: Focuses on salary advances but requires employer partnerships.

- PaySense: Longer tenures (up to 5 years) but stricter credit score requirements.

Market Performance:

Qcash holds a 4.3/5 rating on Google Play with 500,000+ downloads. Users praise its speed and ease of use, though some criticize eligibility criteria and fees. Consistently ranked among India’s top 20 finance apps, it appeals to urban millennials and underserved borrowers seeking hassle-free loans.

-

Crown Heart Photo Editor

Photography | 58.15 MB

Download

-

HiFami - Join & Play Freely!

Entertainment | 116.04 MB

Download

-

DWG FastView-CAD Viewer&Editor

Productivity | 94.46MB

Download

-

Crafto

Art & Design | 174.29 MB

Download

-

Esports Gaming Logo Maker

Art & Design | 31.94 MB

Download

-

America's Pharmacy Rx Savings

Medical | 49.43 MB

Download

-

WeDraw

Art & Design | 5.75 MB

Download

-

Poster Maker - Flyer Creator

Art & Design | 38.48 MB

Download

-

MATE VPN (XY VPN)

Tools | 29.81MB

Download

-

Beauty Camera Plus Selfie Edit

Beauty | 44.45 MB

Download

-

Meta Spark Player

Art & Design | 85.61 MB

Download

-

Holy Bible with Harp

Music & Audio | 17.61 MB

Download